How to Manage Donor-Restricted Funds: FAQs + 8 Key Steps

Updated On: 12/10/2025

Let’s say your nonprofit receives a $10,000 donation to support your food bank in metro Atlanta. After thanking the donor for their generosity, you record the contribution as restricted revenue and start planning how you’ll distribute these funds to different aspects of your food bank program.

This scenario illustrates initial elements of proper donor-restricted fund management. When a donor gives you a contribution for a specific purpose, you document the restricted gift, record the revenue in accordance with Generally Accepted Accounting Principles (GAAP), and use the funds according to the donor’s intent. To bring this scenario to life for your nonprofit, we’ll explore everything you need to know about managing donor-restricted funds:

Donor-Restricted Fund FAQs

What Are Donor-Restricted Funds?

Donor-restricted funds are contributions that donors designate for a specific purpose or timeframe. In the example in the introduction, the nonprofit received a purpose-restricted gift to help fund a food bank program in metro Atlanta. A donor-restricted fund with an associated timeframe may look like a multi-year pledge, a gift for a future period, or a gift in perpetuity. Donors can impose restrictions that are temporary or perpetual—meaning permanent—in nature.

On the other hand, unrestricted funds have no donor-imposed limitations attached, allowing your organization to choose how to spend them. Most small and mid-sized gifts coming directly from your donation page are unrestricted funds.

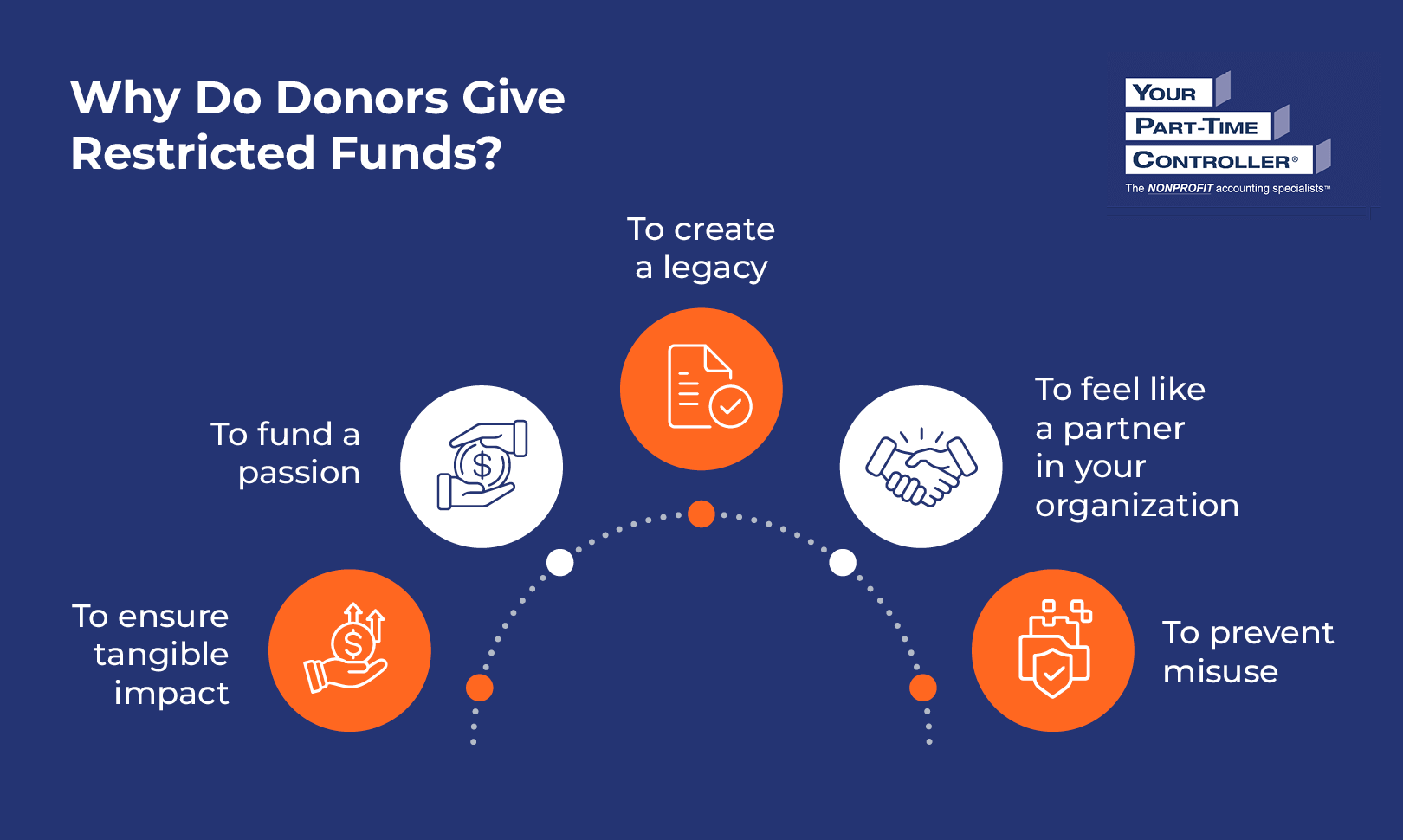

Why Do Donors Give Restricted Funds?

Donors may give restricted funds for several different reasons, such as:

- To ensure tangible impact. Donors want to know exactly how they’re making a difference. When they designate their funds for a specific purpose, donors can be confident in the exact impact they’re making on your cause.

- To fund a passion. Some donors may feel passionate about certain elements of your mission and want to give specifically to those areas. For example, a major donor may contribute to hurricane relief because they received life-changing help from your organization after they lost their home to a hurricane.

- To create a legacy. Large restricted donations often come with naming rights that allow donors to cement their legacy. For instance, you may name a scholarship after the major donor who helped fund it.

- To feel like a partner in your organization. Major donors want to be actively involved in fulfilling your nonprofit’s mission. Giving large restricted donations allows them to steer your resource allocation strategy and gives them a sense of responsibility for your organization’s success.

- To prevent misuse. Only 57% of U.S. adults have high trust in nonprofits, and 61% say that the most important accountability factor is how nonprofits spend their money. Some donors may worry that if they don’t give directly to a specific program or initiative, nonprofits won’t use their funds responsibly.

Understanding donors’ motivations to contribute restricted gifts allows you to tailor your appeals accordingly, assuage their worries, and build deeper relationships with them. For example, while you should still encourage a donor considering a restricted gift to contribute, you can also solicit unrestricted funds by explaining how overhead costs help build your capacity to pursue your mission, thereby setting the foundation for your positive impact.

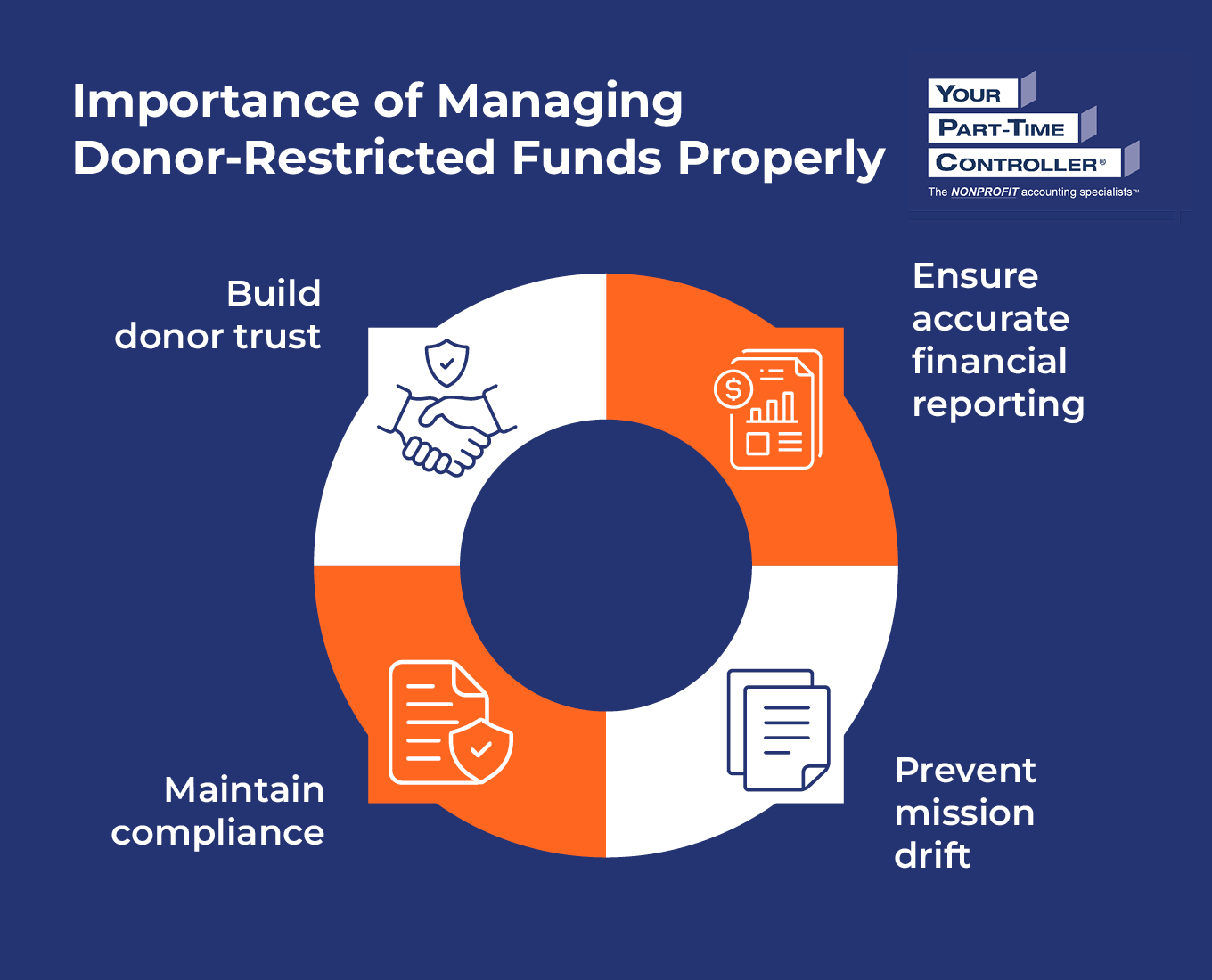

Why Is It Important to Manage Donor-Restricted Funds Properly?

Managing donor-restricted funds appropriately is crucial because it allows you to:

- Maintain compliance. When a donor contributes a restricted gift, it’s not a request; it’s a requirement. Nonprofits must fulfill donors’ designations when using contributed funds. If they don’t, donors may pursue legal action.

- Build donor trust. Misappropriation of donor-restricted funds could lead to negative press coverage and loss of support from key stakeholders like board members, donors, grantors, and corporate partners. These stakeholders support organizations they believe are good stewards of their resources. By using donors’ funds according to their intentions, you build a foundation of trust with your donors, encouraging them to continue supporting your organization for years to come.

- Ensure accurate financial reporting. When you fail to manage donor-restricted funds properly, you give your nonprofit’s leadership a false sense of the organization’s financial standing. Managing, recording, and reporting donor-restricted funds appropriately allows you to make informed financial decisions, avoid costly error corrections, and prepare your organization for financial statement audits.

- Prevent mission drift. Most of the time, restrictions won’t come out of nowhere. You’ll typically have conversations with major donors about your organization’s priorities and should only apply for grants that support your goals. When you have a solid plan and strong policies and procedures for soliciting and accepting donor-restricted funds, you’ll ensure that your organization receives a mix of funding that aligns with your mission.

When you manage donor-restricted funds with care, everyone wins. Donors can make their intended impact, leadership can make stronger financial decisions, and your nonprofit can maintain its standing as a compliant, trustworthy, and mission-focused organization.

What Are the Different Types of Donor Restrictions?

Understanding the different types of donor restrictions ensures you track them properly in your chart of accounts and report them accordingly in your financial statements. Let’s explore the different types of funds your nonprofit may receive.

Funds Without Donor Restrictions

Formerly reported as “unrestricted funds,” these are contributions your nonprofit can use at your discretion—often for general operations. Most small and mid-size individual donors will contribute funds without donor restrictions. However, it’s important to pay attention to the wording of the solicitation the donor responded to, as well as anything an unsolicited donor may write in when they contribute (e.g., in the memo line of a check or in the note field of an online donation).

When you receive funds without donor restrictions, you can allocate them toward any of your main expense categories, including:

- Management and general expenses like executive salaries, benefits administration, and rent or mortgage payments

- Fundraising expenses like campaign expenses, event costs, and fundraising staff time

- Program expenses that haven’t been covered by restricted funds, like program materials and program staff salaries

Common types of funds without donor restrictions include most individual donations made through your donation page, fundraising event revenue, membership dues, matching gifts, and investment income. If you’re running a campaign for a specific program or purpose and tell donors that’s what their money will go toward, always follow through with that promise to maintain trust and transparency.

Funds With Donor Restrictions

When you receive funds with donor restrictions, you must use them according to the donor’s stipulations. While your nonprofit will report all of these funds as “funds with donor restrictions” in its financial statements, you’ll record these funds internally in your chart of accounts according to their restriction type.

Temporarily Restricted Funds

Temporarily restricted funds can be reclassified as unrestricted funds once the nonprofit has fulfilled the donor’s designated purpose (for purpose-restricted funds) or the timeframe specified by the donor has elapsed (for time-restricted funds). However, some donors prefer that nonprofits return any extra funding or allocate it toward another specific project.

Common types of temporarily restricted funds include major and planned gifts, grants, and corporate sponsorships. For example, let’s say you secure a $60,000 sponsorship with a local business to fund your animal rescue organization’s gala. If you only end up needing $55,000 to put toward your event, you may request the company’s permission to release the extra $5,000 from restriction. Then, you could allocate those funds to other areas of your budget, such as planning next year’s event or buying more supplies for shelter animals.

Permanently Restricted Funds

As the name suggests, permanently restricted funds must be held in perpetuity for a donor-specified purpose. The most common example of a permanently restricted fund is an endowment. Typically given to universities or cultural organizations, endowments are large donations that your organization invests according to the investment policy for the endowment.

Then, you’ll use the investment earnings to fund a donor-specified purpose according to the endowment’s withdrawal and usage policies. For example, a college alumnus may contribute to an endowment that funds continuation of the cutting-edge research they helped conduct when they were an undergraduate student.

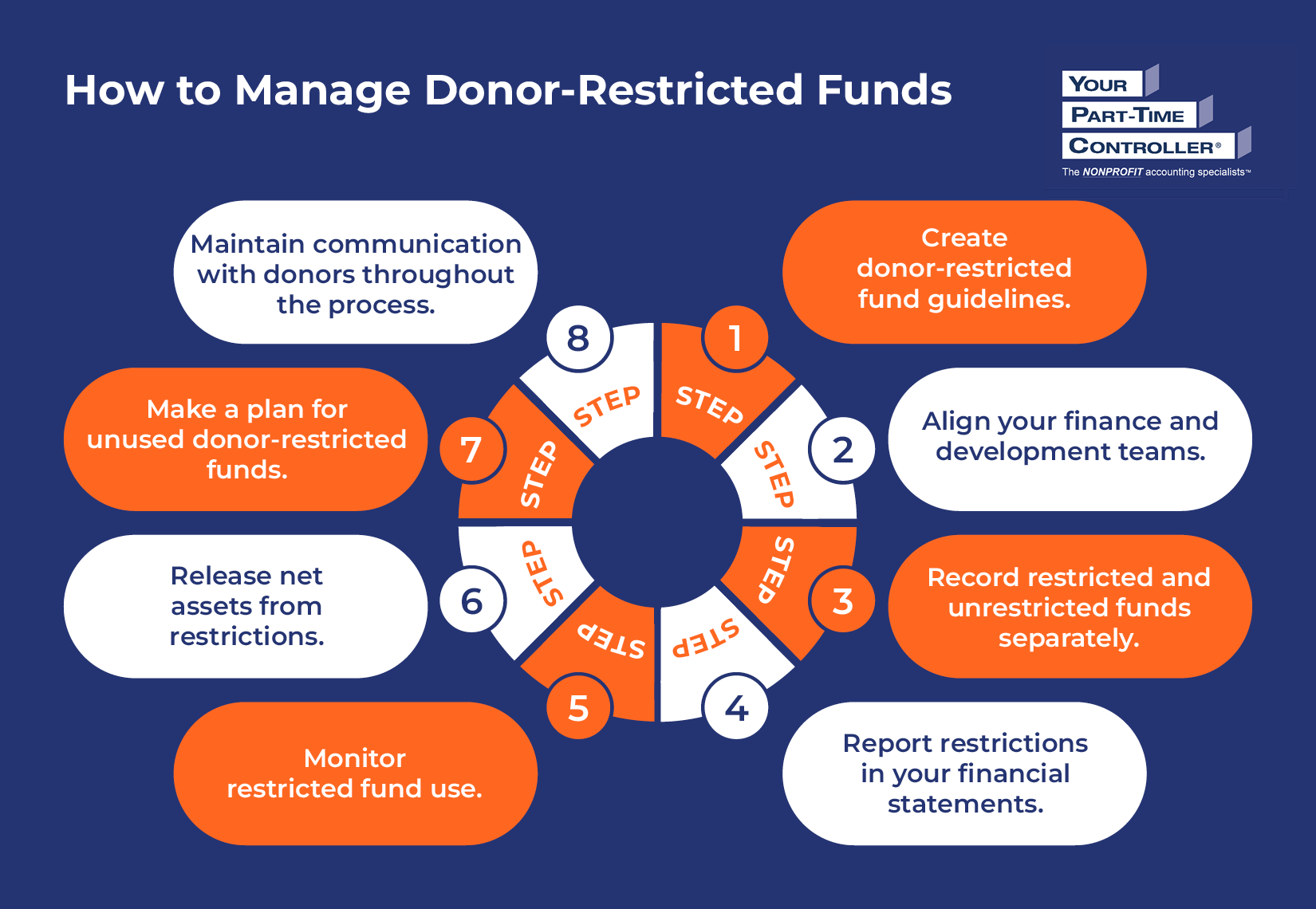

How to Manage Donor-Restricted Funds

1. Create donor-restricted fund guidelines.

Prepare your team to manage restricted funds properly with formal guidelines. You may create a donor-restricted funds policy or add a section to your existing gift acceptance policy for donor-restricted funds. Either way, include the following information:

- Definition of the different types of restricted funds

- Procedures for accepting donor-restricted funds

- Recording, tracking, reporting, and reallocating guidelines, including individual or team responsibilities

Share your donor-restricted funds policy broadly across your team so everyone knows their role in managing restricted funds. Consider also sharing your policy on your website to build trust with donors and to help them understand your requirements for restricted gift acceptance before they contribute.

2. Align your finance and development teams.

Keeping your finance and development teams on the same page about donor-restricted fund management allows you to stay organized and maintain compliance. Follow these tips to align your staff:

- Establish a gift review process. Have your development director or nonprofit controller review complex gift agreements before you sign them. When gifts are large or have multi-year payout schedules or unusual restrictions, they may be more complex to manage. If you choose to accept these gifts, the responsible parties will need time to make a plan for tracking, reporting, and compliance.

- Decide how to handle indirect costs. Restricted fund management comes with its own set of costs, such as staff time, audit fees, customized reporting, and technology. Include indirect costs in grant proposals and discussions with major funders.

- Reconcile finance and development records monthly. Compare restricted gifts recorded in your constituent relationship management platform (CRM) and accounting system on a monthly basis to ensure they match. Both systems should use the same wording for donor restrictions to avoid confusion and prepare for audits.

Both teams should also understand each other’s goals and pain points within the donor-restricted fund management process to build empathy and promote smooth collaboration. For example, while your finance team might explain the accounting complexity that comes with accepting certain restricted funds, the development team might emphasize the importance of building strong relationships with major donors who want to direct the use of their funds. With regular and transparent communication, the two teams can identify and agree on solutions that address all needs.

3. Record restricted and unrestricted funds separately.

Separating restricted and unrestricted funds within your accounting system ensures you adhere to donors’ restrictions. These steps should help you set up your system accordingly:

- Create net asset subcategories. Under your net assets account category in your chart of accounts, create subcategories for temporarily restricted, permanently restricted, and unrestricted funds.

- Create revenue and expense subcategories. Under your revenue account category, create subcategories for the different types of restricted funds you may receive, such as government grants, non-government grants, and corporate sponsorships. Expense account subcategories might include personnel, employee benefits, and facilities and equipment costs. Importantly, do not create separate accounts for every program, grant, or funder. Only create accounts that are standard for your industry and that you will use year after year.

- Track revenue and expenses by program. While you should not create separate accounts for programs, grants, and funders, you may be able to use another function in your accounting software to track them, such as Classes in QuickBooks Online. Work with a nonprofit accountant like YPTC who can help you set up the proper function in your accounting system.

- Track activity by funder. Your accounting software may also have a feature you can use to track your revenue and expenses by funding source. In QuickBooks Online, for example, you would use a tracking feature within the Customer dimension. If needed, a nonprofit accounting expert can help you identify and set up this function within your system.

With this setup, you can run reports within your accounting software that show your revenue and expenses by program and by funding source. This reporting can help you understand where you have funds left to spend and where you need to focus additional fundraising efforts.

4. Report restrictions in your financial statements.

Generally Accepted Accounting Principles (GAAP) require nonprofits to report on funds with and without donor restrictions. More specifically, you’ll report on donor restrictions within the following financial statements:

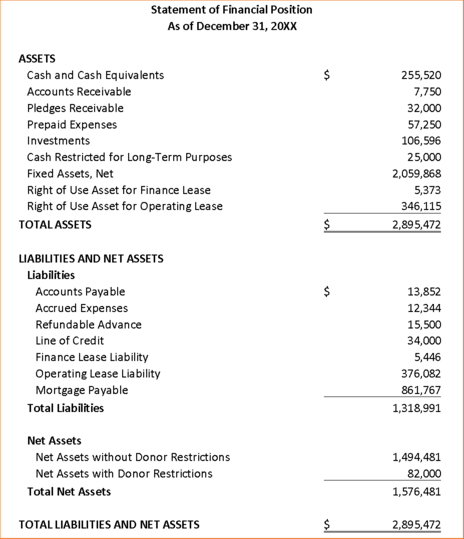

Statement of Financial Position

Within your Statement of Financial Position, you’ll report on net assets with and without donor restrictions as shown in the example of this statement below. By separating your net assets this way, stakeholders can better understand the total financial resources available to your organization, the amount you can use freely to cover any expenses, and the amount subject to donor restrictions.

Additionally, your balance sheet will include a line item for refundable advance, a nonprofit-specific liability that represents cash or other assets subject to donor-imposed conditions. These funds are a liability until you meet the conditions because if you don’t, you must return the contributed assets.

Lastly, this document also has a section called pledges receivable, which represents promises from donors to donate cash or other assets in the future. These may end up being donor-restricted funds if the donor contributes to a certain project, like a capital campaign.

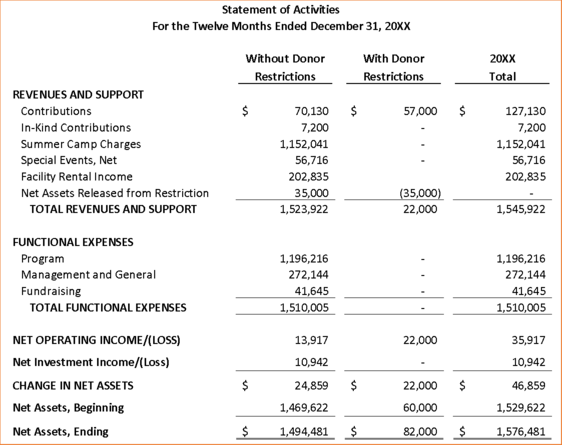

Statement of Activities

Structure your Statement of Activities so that revenues and support, expenses, and change in net assets are the categories for each row, with columns for without donor restrictions, with donor restrictions, and the annual total. This structure is illustrated in the example of this statement below and allows you to report on resources that have restrictions attached.

Additionally, under revenues and support, you’ll include net assets released from restrictions (see step 6). These represent previously restricted net assets in which the donor’s stipulated time has elapsed or the intended purpose for the funds has been fulfilled.

5. Monitor restricted fund use.

After setting up your accounting system, budget for each initiative that is supported by restricted funds. Then, monitor how you use restricted funds to ensure you allocate them appropriately. Incorporate these best practices into your management process:

- Assign fund management responsibilities. Distribute responsibilities for each restricted fund category or project among your team. Fund or program managers and accounting staff should oversee the use of donor-restricted funds and report on fund activity.

- Track expenditures in real time. Each fund manager should track expenditures within their category or project to ensure they align with donors’ restrictions. Additionally, they should compare your budgeted and actual expenses. If there are major discrepancies, they should adjust their strategy accordingly.

- Maintain detailed records. By keeping transaction records, such as receipts, invoices, and proof of expenditures, fund managers can help you stay accountable and transparent with donors. They should also maintain records of communications with donors regarding fund use to uphold donors’ stipulations.

Make sure donors are aware of these procedures. Knowing you have a clear process for monitoring restricted funds will instill confidence in your organization and encourage them to give.

6. Release net assets from restrictions.

When the donor’s stipulated time frame has elapsed, the stipulated purpose has been fulfilled, or both, release the restricted funds by reclassifying them from net assets with donor restrictions to net assets without donor restrictions in the period during which the restriction(s) expired.

As mentioned above, net assets released from restriction are reported under revenues and support on your Statement of Activities.

If you adopt a “simultaneous release policy” in which you report contributions whose restrictions are met in the same period as the revenue is recognized as unrestricted, document the policy, disclose it in your financial statement notes, and apply it consistently.

7. Make a plan for unused donor-restricted funds.

Sometimes, even with careful budgeting and planning, you’ll have unused donor-restricted funds. Create guidelines for how you’ll handle these funds.

If appropriate, you may follow up with donors and ask for permission to reallocate their contributions. Try to align these requests as closely as possible to their original intentions.

For example, let’s say a donor contributed to fully fund your church camp’s transportation for the year. However, you experienced cost savings, leaving you with extra donor-restricted funds. In this scenario, you may reach out to the donor and ask if they’d allow your church to use the leftover funds to support the transportation service you provide to seniors.

If you obtain the donor’s permission to use the leftover funds, be sure to reclassify the funds in your accounting system and report the release of net assets from restrictions in your Statement of Activities.

8. Maintain communication with donors throughout the process.

Stay transparent with donors and show them you’re using their funds as they intended. Send regular reports to donors who have contributed restricted funds to show how you’ve used their contributions so far and how you plan to use the remaining balance.

Additionally, share impact information that shows how their gifts have positively impacted your cause. For example, you might share that, thanks to a donor’s gift to your soup kitchen, you’ve already provided meals for dozens of local families in need.

Additional Donor-Restricted Fund Management Resources

Donor-restricted funds can significantly increase your nonprofit’s ability to make an impact—but only if you record, manage, and report on them properly. By developing a donor-restricted fund management process, you can keep your team organized, uphold donors’ conditions, and maintain compliance.

If you need help managing donor-restricted funds, reach out to YPTC. Our team of nonprofit financial management experts is ready to assist you, from policy development and accounting system setup to grant management and reporting. Contact us to get started.

For more information on managing and accounting for donor-restricted funds, check out the following resources:

- When a Gift Comes with Strings Attached: A Practical Guide to Navigating Donor-Restricted Funds for Faith-Based Organizations. Explore how your faith-based organization should navigate donor-restricted funds.

- What Is a Nonprofit Balance Sheet? Breaking Down This Report. Learn how to report donor-restricted funds properly on your nonprofit balance sheet.

- Top Nonprofit Audit Preparation Guide: What You Need to Know. Dive into nonprofit audit preparation, which includes reporting restricted gifts properly.

Jennifer Alleva

Jennifer Alleva is the Chief Executive Officer at Your Part-Time Controller, LLC (YPTC), a leading provider of nonprofit accounting services and #65 on Accounting Today’s list of Top 100 accounting firms. Jennifer brings over three decades of expertise in accounting and leadership to her role as CEO of YPTC.

When Jennifer joined YPTC in 2003, the firm consisted of just over 10 staff members. Since then, she has helped grow YPTC into one of the fastest-growing accounting firms in the country.

Jennifer’s accomplishments include her tenure as an adjunct professor at the University of Pennsylvania Fels Institute, her frequent speaking engagements on nonprofit financial management issues, her role as the founder of the Women in Nonprofit Leadership Conference in Philadelphia, and her launch of the Mission Business Podcast in 2021, which spotlights professionals and narratives from the nonprofit sector.